If you’ve checked out rental listings lately, you know that rents are going up, up, up. Demand for apartments has surged, making many markets super competitive. Finding a place to call home at a reasonable price can be challenging. The burning question is: how much of your income should go toward a rent budget?

For many high school students, senior year is an exciting time—and an expensive one. Between car shopping, campus tours, and prom night, there’s a lot going on during the time leading up to graduation. During this transition period to independence and adulthood, it’s essential to build key life skills. Learning how to budget and manage money now will help set students up for a lifetime of financial success.

With classes moving towards online or hybrid learning, the need to have access to a reliable machine becomes more and more necessary with each passing year. With so many options for performance, features, and of course price, how do you choose a machine that will fit your needs without burning your budget?

Does this happen to you? You toss out mystery leftovers from the back of the fridge or throw away a half-eaten bulk box of cereal that’s gone stale. Food waste is a bigger problem than most people realize, and when you throw away food, you’re also throwing away money.

Want to learn how to waste less and save more? In this article, we’ll show you eight simple ways to reduce your food waste.

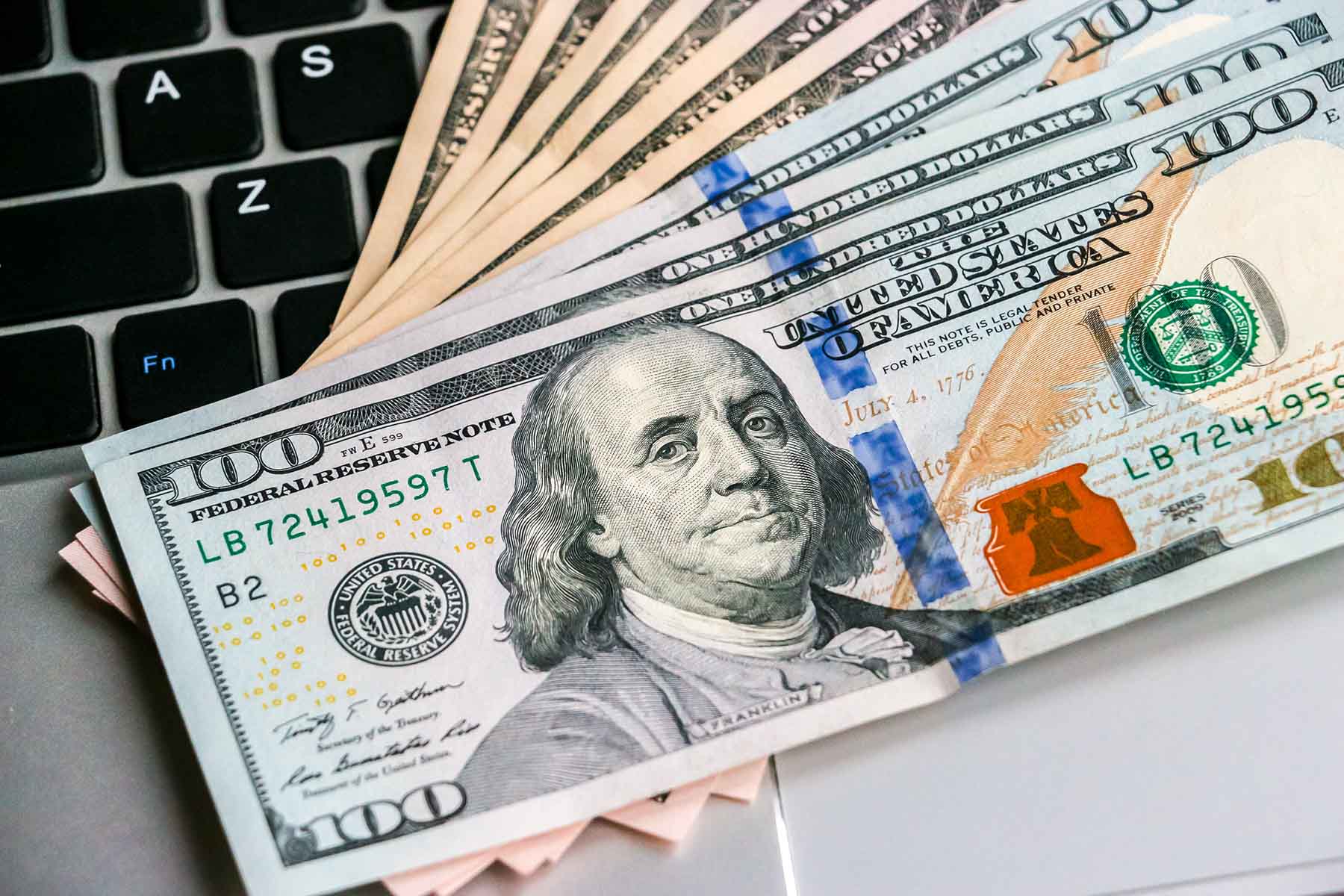

Between the rising cost of groceries, gas, and general life expenses, it can be hard to stay on top of all your bills, let alone get ahead. If you’re struggling to make your money last until your next payday, you’re not alone. This survey found that more Americans than ever are living paycheck to paycheck – including a third of people who make six figures a year.

There are many reasons why it feels difficult to save money. Economic circumstances, debts, emergencies, or impulse purchases can all wreak havoc on our savings accounts—or prevent us from building our savings in the first place.

Tracking where your money is going is the first step to saving more of it. Continue reading to learn strategies for saving based on your individual challenges.

If you’ve got first-class travel dreams but more of a road-trip budget, don’t worry: It’s possible to explore the world without wrecking your wallet. Here are some money-saving travel tips to help you keep costs down before, during, and after your trip.

Since 2007, America Saves Week has been inspiring people of all ages to commit to building and maintaining good savings habits. This year’s theme is “A Financially Confident You,” and it’s all about taking control of your finances to achieve financial well-being.

In honor of America Saves Week, here are some money-saving tips to help you boost your financial confidence and empower your financial future.

Whether your goal is to save $500 or $5,000, methods used for saving can be easily scaled to accomplish any dream. Developing a plan early into the year can be inspiring, but you don’t need to wait for a new year to get started.

Knowing which products earn the highest dividends will help you reach your goal faster. Depending on your needs, a high yield savings account or certificate are excellent choices for the determined saver.

If you didn’t snag all the Black Friday and Cyber Monday deals you were hoping for — or if you didn’t receive everything on your own wish list over the holidays — don’t worry. There are a ton of awesome shopping deals to be had after Christmas. With some planning, patience, and strategic shopping, you can score deep discounts from both big-box stores and mom-and-pop businesses trying to reduce their inventory and make room for new items in the new year. Here are some savings you can look forward to after Santa returns to the North Pole.

Planning any New Year’s resolutions for 2023? Along with goals like eating healthier and exercising more, money-related resolutions are common. If you’ve committed to tackling debt or saving more in the coming year, that’s great news.

Here’s how you can take this goal even further: Try becoming more mindful about your money. It’s a personal change that could really pay off, and not just financially.

While the holiday season may be a time of tradition for many, changing economic factors will force many to adapt their habits to fit a tighter budget this year.

According to Deloitte’s 2022 Holiday Retail Survey, shoppers plan to buy 9 gifts in 2022 versus 16 in 2021, citing rising prices. Despite this, consumers plan to maintain spending levels, spending an average of $1,455, similar to last year’s $1,463 average.

Knowing that shoppers don’t expect their dollar to go as far, what options exist for budget-conscious consumers who still want to create happy holidays?

There are only twenty-four hours in a day, and how you spend each one can impact your entire life. If you frequently find yourself trying to magically turn back the clock, you may be in “time debt.”

Money can’t buy happiness – is that even true?

When it comes to wealth and well-being, great minds think differently. Arthur Schopenhauer once declared, “Money alone is absolutely good,” while Seneca the Younger cautioned, “Money has never yet made anyone rich.” Perhaps a balanced perspective is needed – and as the legendary financial commentator Louis Rukeyser once quipped, “The best way to keep money in perspective is to have some.”

Now that we’ve created the Financial Wellness Dictionary for young adults to educate themselves on the most relevant terms to begin their financial wellness journey, the next step is to establish yourself at a financial institution. In today’s blog, we look at a handful of starter accounts, products, and services young adults should have or start familiarizing themselves with to continue towards financial independence.

If you did a double-take the last time you checked out at the store or paid at the pump, you’re not alone. Right now, inflation is in overdrive, and people are feeling the pinch in their wallets. Inflation may be out of your control, but you can act to take the sting out of rising prices.

Debit cards have evolved quite a bit over the years. Here at American Heritage, our Independence Debit Card just keeps getting better – with new features and perks to help you save time and get more for your money. Let’s take a closer look.

Vacations are the perfect opportunity for some well-deserved relaxation and making new memories. Get the most out of your getaway by planning your trip in advance. This way, you can spend your vacation time stress-free!

The last thing you should worry about on vacation is money. In this article, we offer tips or mindful spending and planning for travel.

You’re not a kid anymore, and you’ve got some exciting things to look forward to. If you aren’t heading to college, you may be starting at a trade school or joining the workforce. No matter what your next step is after high school, making smart financial decisions will help you start strong. Learning how to successfully manage your money now is an essential skill that will pay off for decades — literally!

As the temperature outside starts to rise, so does the cost of keeping your home cool. Typically, electricity rates are higher during the summer due to increased demand, leading to higher summer electric bills. If you want to secure a lower electric bill (without feeling like you’re living in a sauna), check out these 26 energy-saving tips for summer. We’ve got ideas from A to Z!