Money conversations aren't exactly candlelit dinner material, but they're one of the most important discussions couples must have. Regardless of how long you've been a couple, different spending styles can create financial friction, and that's completely normal—and solvable.

Review simple steps you can use to stay safe online, including stronger passwords, fraud alerts, card controls, and more tools to protect personal information.

When using a home equity loan or home equity line of credit for home improvements, you may be able to make the most of tax deductions that come from the interest of these funds.

Learn about Home Equity Lines of Credit, including what they are, if you would be a good candidate to apply for one, and the pros and cons of a HELOC.

Build better financial habits in the new year with these small but powerful money moves. Discover simple ways to save, automate, and spend smarter in 2026.

Read about the best times of year to make certain purchases, like the best time to buy a home, car, mattress, furniture, and more.

Big goals can be tough to keep. Try these small, achievable money habits, like automatic savings and and weekly check-ins, to build a healthier financial year in 2026.

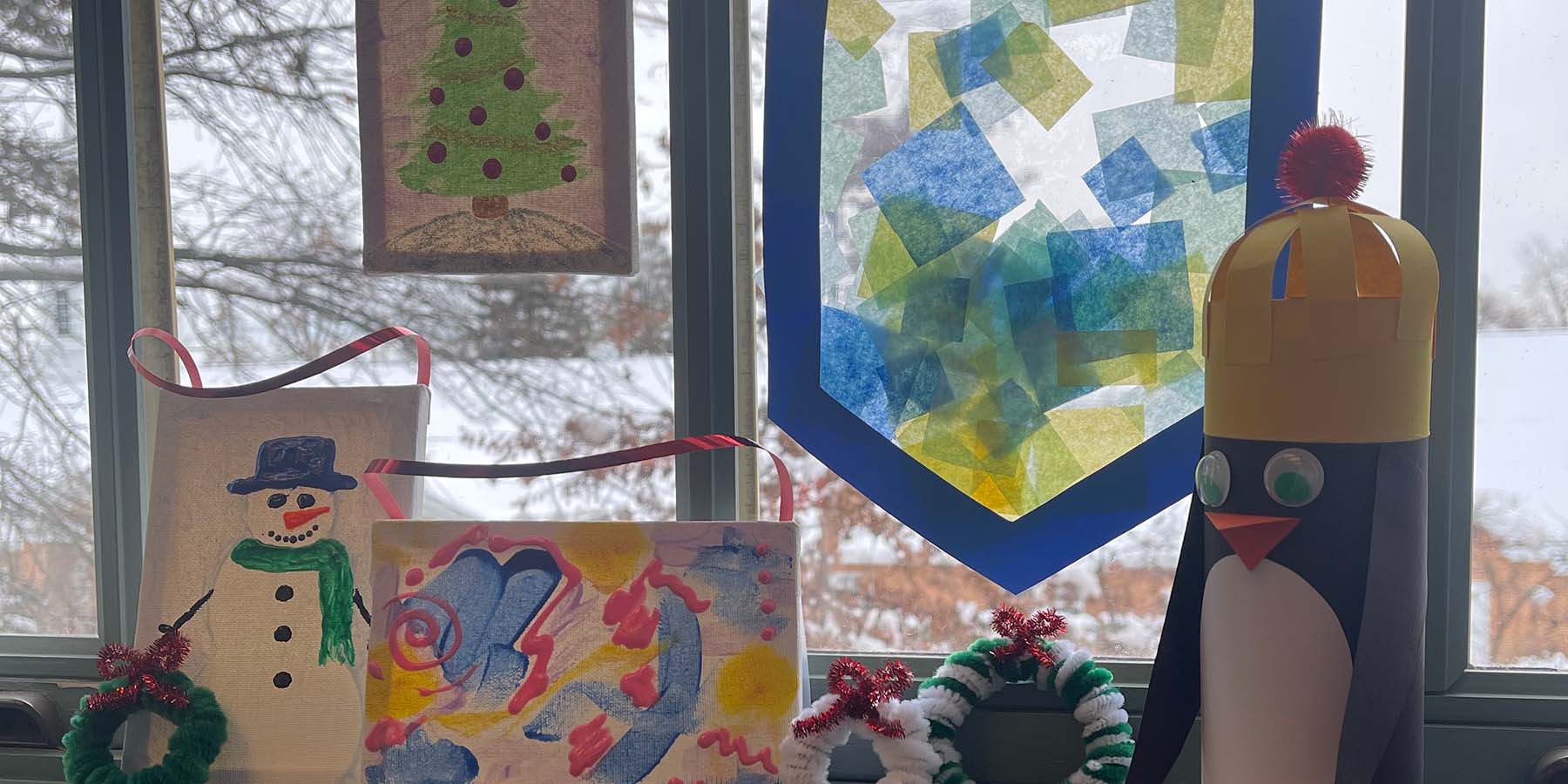

Check out 4 simple, DIY crafts you can complete this holiday season with the whole family. Supplies can be purchased at the dollar store or may be at home.

Discover simple, thoughtful tips to reduce stress, manage money, and create a more meaningful holiday season.

By: American Heritage12.04.25

Auto

Learn about your options for auto financing, including leasing vs. financing, paying cash, and financing with a financial institution vs. a dealership.

Learn tips you can follow for shopping this holiday season, like budgeting, avoiding impulse purchases, and earning rewards with the American Heritage.

Review the need to enroll in benefits that fit the needs of you and your family during open enrollment. See tips for comparing plan options and coverages.

While there’s a lot to be thankful for with the Thanksgiving holiday, one item that may not be so appreciative is your wallet. Between the meal itself, travel, decorations, and more, it may feel like the taps, swipes, and purchases never stop. However, with the proper budget and strategy in place, you can pull off a successful Thanksgiving that won’t empty your bank account.

Tokenization is a process that combats fraud and protects your personal and payment information from hackers.

Learn about the costs associated with having a newborn baby in 2025, including expenses like healthcare and delivery, cribs, strollers, and more.

When you hear the phrase "financial independence," do you picture someone sipping cocktails on a beach after retiring at 50? While that sounds nice, real financial independence isn't one-size-fits-all. It could simply mean sleeping better at night knowing your bills are paid, your debt is manageable, or you've got a plan for what comes next.

Credit unions may not immediately come to mind when thinking about history. But the truth is, credit unions have played an important role in shaping financial identity through the ages.

Learn about 7 simple cybersecurity tips you should follow, such as creating unique passwords, updating devices, and backing up your data.

Did you miss your Annual Notice of Change (ANOC) from your insurance company? If so, you're not alone. In fact, new research shows that only 48% of Medicare beneficiaries read every piece of mail sent by their insurance company. Of those that do read their Annual Notice of Change from their insurance company, only 36% of Medicare beneficiaries say they find the information in their plan's letter easy to understand.

Marriage marks the beginning of an exciting chapter, but it also comes with new responsibilities – chief among them, managing money as a team. From differing spending habits to tackling debt, money matters can quickly become a source of tension if not addressed promptly. With open communication and a proactive approach, couples can navigate these financial hurdles and build a strong foundation for their future together.